|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Chinese New Year - Year of the Tiger

- February 14 2010

Chinese New Year - Year of the Tiger

- February 14 2010

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Jan 29, 2010

Hong Kong*:

The Anglican Church in Hong Kong has been ordered to pay HK$180 million in

outstanding tax on a joint development which turned a Tai Po site into a luxury

residential zone. Hong Kong*:

The Anglican Church in Hong Kong has been ordered to pay HK$180 million in

outstanding tax on a joint development which turned a Tai Po site into a luxury

residential zone.

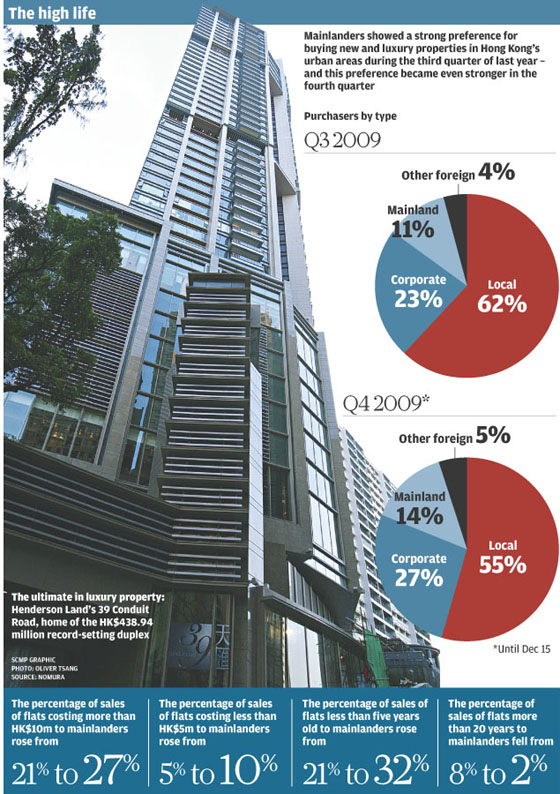

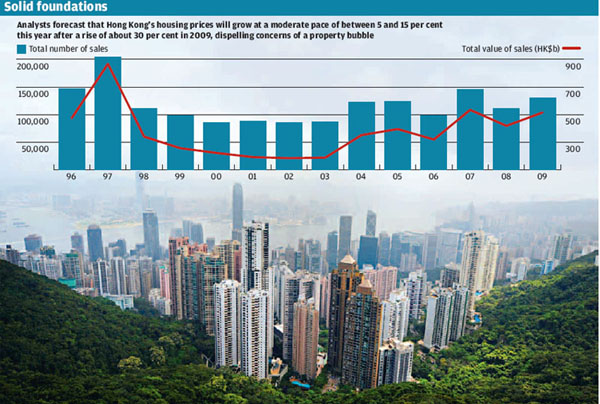

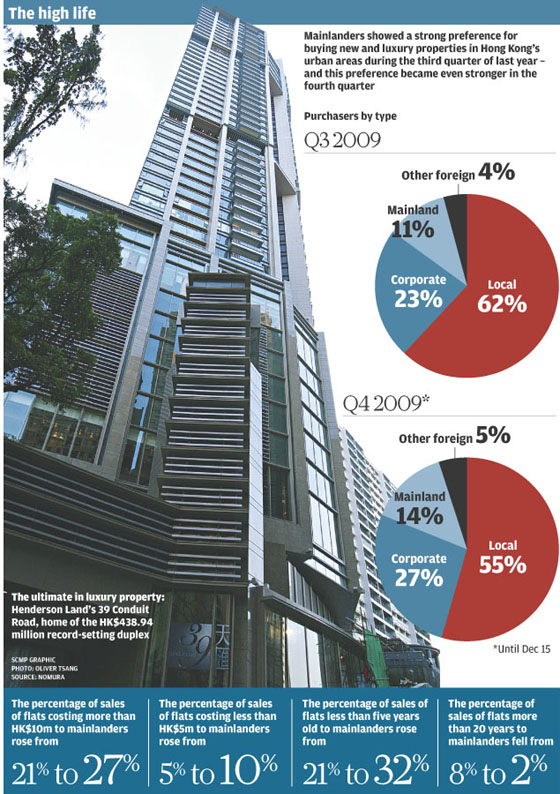

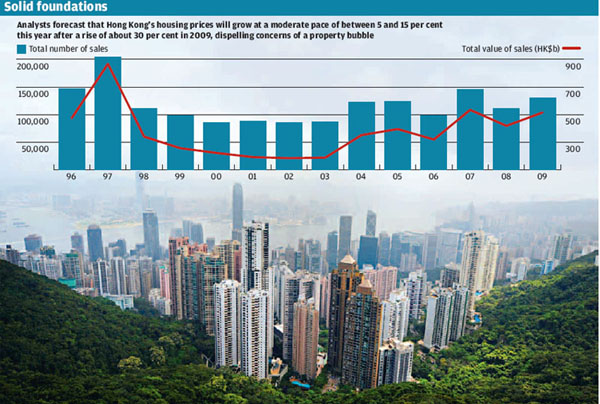

Net profit of Hang Lung Properties (0101)

soared 13-fold to HK$17.3 billion thanks to strong sales and fair value gain.

Underlying profit for the six months to December rose fourfold to HK$5.5 billion

after excluding related tax and a HK$16.1 billion revaluation gain. The builder

and landlord declared an interim dividend of 17 HK cents, up 13 percent from a

year ago. Hang Lung sold 425 homes at HK$14,000 per square foot in August. This

lifted property sales up from HK$11 million last year - when no project was

launched - to HK$7.5 billion. "It has always been the market which tells us when

to sell our units," said executive director Terry Ng Sze-yuen. "After The Long

Beach in October 2007, we did not launch any project until this [financial]

year." Chairman Ronnie Chan Chi-chung said the firm is "in no rush" to sell the

remaining 284 homes at The HarbourSide, and 1,200 flats at The Long Beach. There

is no property bubble in Hong Kong, Chan said, adding that small and medium

homes are still affordable. He noted the government has become significantly

more lenient with land applications. "I just don't believe developers are braver

under the current adverse conditions than the boom market two years ago."

Problems will definitely arise if the government does not sell land, Chan said,

but he is hopeful that the supply of affordable flats will rise. While Ng finds

Hang Lung's local rental increase of 5 percent reasonable, Chan said rental

contribution from the mainland will exceed that from Hong Kong within two years.

Retail complex Palace 66 in Shenyang, which will be completed in mid-2010,

already has 80 percent committed tenancies. Chan expects annual returns of 5-6

percent in the first three years at the project. Returns on Hang Lung's two

Shanghai malls topped 40 percent while rentals were at least twice that of its

neighbors. The firm's land bank comprises 20 million square feet in prime

mainland commercial locations. Net profit of Hang Lung Properties (0101)

soared 13-fold to HK$17.3 billion thanks to strong sales and fair value gain.

Underlying profit for the six months to December rose fourfold to HK$5.5 billion

after excluding related tax and a HK$16.1 billion revaluation gain. The builder

and landlord declared an interim dividend of 17 HK cents, up 13 percent from a

year ago. Hang Lung sold 425 homes at HK$14,000 per square foot in August. This

lifted property sales up from HK$11 million last year - when no project was

launched - to HK$7.5 billion. "It has always been the market which tells us when

to sell our units," said executive director Terry Ng Sze-yuen. "After The Long

Beach in October 2007, we did not launch any project until this [financial]

year." Chairman Ronnie Chan Chi-chung said the firm is "in no rush" to sell the

remaining 284 homes at The HarbourSide, and 1,200 flats at The Long Beach. There

is no property bubble in Hong Kong, Chan said, adding that small and medium

homes are still affordable. He noted the government has become significantly

more lenient with land applications. "I just don't believe developers are braver

under the current adverse conditions than the boom market two years ago."

Problems will definitely arise if the government does not sell land, Chan said,

but he is hopeful that the supply of affordable flats will rise. While Ng finds

Hang Lung's local rental increase of 5 percent reasonable, Chan said rental

contribution from the mainland will exceed that from Hong Kong within two years.

Retail complex Palace 66 in Shenyang, which will be completed in mid-2010,

already has 80 percent committed tenancies. Chan expects annual returns of 5-6

percent in the first three years at the project. Returns on Hang Lung's two

Shanghai malls topped 40 percent while rentals were at least twice that of its

neighbors. The firm's land bank comprises 20 million square feet in prime

mainland commercial locations.

The US consulate has taken an interest in the pan-democrats' by-elections plan,

according to a League of Social Democrats official. "I have the feeling that

their biggest concern was whether we would win or lose the seats," league

vice-chairman Andrew To Kwan-hang said yesterday of his meeting with consul for

political affairs Benjamin Weber, which he said took place two or three months

ago. The consul did not offer any support, and the league would reject it even

if he did offer any, To said. "In return, I also asked him how the United States

viewed our referendum. He said his country had democracy and that `Hong Kong has

enough smart people to deal with it'," To said. Weber asked for a meeting with

league chairman Wong Yuk-man - in whose office the meeting with To was held. A

meeting between the two has not been arranged since the talks. To said Weber was

the only diplomat to approach the league about the resignations plan. "It was

the first time I had official talks with the US consulate. They had never

approached us before ... I think they have regular contacts with the Civic Party

and the Democratic Party, but not the League of Social Democrats," To said.

Without confirming or denying the meeting, a spokesman for the consulate said:

"In pursuit of our official duties, consulate general officials routinely meet

with leading government and non-government figures across the full range of

political views, including academics, journalists, businesspeople, politicians

and NGO leaders." Civic Party vice-chairman Alan Leong Kah-kit, one of the five

legislators to resign yesterday, said he was not aware of any consulate asking

his party about the campaign. He said lawmakers regularly gathered with guests

from different countries and discussed issues of concern. Liberal Party

executive committee member Michael Tien Puk-sun - who had expressed his

intention to contest the by-elections the resignations will trigger but will not

do so now after his party's decision not to contest the polls - said no foreign

consulate had approached his party regarding the by-elections. "I am not

surprised that the US consulate is interested in this matter. It has always been

interested in Hong Kong and China politics," said Tien, a National People's

Congress deputy.

HSBC Group Chief Executive Michael

Geoghegan poses in front of HSBC headquarters in Central as he starts his first

day of work on Wednesday. HSBC Holdings (SEHK: 0005) chief

executive Michael Geoghegan said on Wednesday that tougher United States

regulations to limit the size and activities of America’s largest banks would

have little impact on HSBC. US President Barack Obama has proposed significant

limits on how banks can operate. This includes stopping retail banks using their

own money in investments. Banks may instead be limited to investing their

customers’ funds. Geoghegan made the comments to reporters on his first day of

work with HSBC in Hong Kong – after re-locating from London. “We have a surplus

in our banks in America and Canada. So, I don’t think this [the proposed changes

to banks] would affect us too much,” the 56-year-old British-born banker said.

Geoghegan said that when the new regulations become law they might be “slightly

different” from what some people were now advocating. “We would encourage the

regulators – the Basel Committee – and others, to think carefully about the

changes they want to make,” he said. The Basel Committee on Banking Supervision,

made up of central bankers and regulators from nearly 30 countries, is putting

together a package of stricter financial rules in response to the credit crisis.

“Everybody wants a strong banking system and to make sure it’s a level playing

field. But that’s not easy to achieve. That will take it some time,” he added.

On Wednesday, Geoghegan was welcomed by over 100 HSBC staffers. He said HSBC was

a truly international (SEHK: 0732) operation. “We have a chief executive in Hong

Kong and a chairman in London. The chief executive now runs the entire group and

the team is spread all over the world. Some are in London, some are in New York

and some in Brazil and Mexico,” he said. Geoghegan said he would meet Hong

Kong’s major political officials and clients later. HSBC announced its decision

to move its chief executive from London to Hong Kong last September – a move

that indicates it is focusing more on the mainland in future. The bank has also

hired financial advisers to prepare a listing on the Shanghai Stock Exchange.

Michael Geoghegan joined HSBC in 1973 and previously led the group’s South

American and European operations. He is the first chief executive based in Hong

Kong since William Purves in the early 1990s. HSBC Holdings has been

headquartered in London since 1993. HSBC Group Chief Executive Michael

Geoghegan poses in front of HSBC headquarters in Central as he starts his first

day of work on Wednesday. HSBC Holdings (SEHK: 0005) chief

executive Michael Geoghegan said on Wednesday that tougher United States

regulations to limit the size and activities of America’s largest banks would

have little impact on HSBC. US President Barack Obama has proposed significant

limits on how banks can operate. This includes stopping retail banks using their

own money in investments. Banks may instead be limited to investing their

customers’ funds. Geoghegan made the comments to reporters on his first day of

work with HSBC in Hong Kong – after re-locating from London. “We have a surplus

in our banks in America and Canada. So, I don’t think this [the proposed changes

to banks] would affect us too much,” the 56-year-old British-born banker said.

Geoghegan said that when the new regulations become law they might be “slightly

different” from what some people were now advocating. “We would encourage the

regulators – the Basel Committee – and others, to think carefully about the

changes they want to make,” he said. The Basel Committee on Banking Supervision,

made up of central bankers and regulators from nearly 30 countries, is putting

together a package of stricter financial rules in response to the credit crisis.

“Everybody wants a strong banking system and to make sure it’s a level playing

field. But that’s not easy to achieve. That will take it some time,” he added.

On Wednesday, Geoghegan was welcomed by over 100 HSBC staffers. He said HSBC was

a truly international (SEHK: 0732) operation. “We have a chief executive in Hong

Kong and a chairman in London. The chief executive now runs the entire group and

the team is spread all over the world. Some are in London, some are in New York

and some in Brazil and Mexico,” he said. Geoghegan said he would meet Hong

Kong’s major political officials and clients later. HSBC announced its decision

to move its chief executive from London to Hong Kong last September – a move

that indicates it is focusing more on the mainland in future. The bank has also

hired financial advisers to prepare a listing on the Shanghai Stock Exchange.

Michael Geoghegan joined HSBC in 1973 and previously led the group’s South

American and European operations. He is the first chief executive based in Hong

Kong since William Purves in the early 1990s. HSBC Holdings has been

headquartered in London since 1993.

A typical two-axle double-decker which

will be introduced by Kowloon Motor Bus next month to save costs and to protect

the environment. The new model meets Euro V emission standards. Kowloon Motor

Bus will introduce a new two-axle double-decker in a bid to cut costs and reduce

pollution. The new model, to be introduced next month during non-peak hours,

meets the Euro V emission standard, which means it releases at least 40 per cent

less nitrogen oxide emissions than most buses on the road. Most Hong Kong buses

are 12-metre double-deckers with three axles. The two-axle buses are not only

cleaner but are more cost efficient. However, they do have a smaller capacity of

88 passengers, compared to over 140 for larger models. "We could deploy these

smaller and greener buses during non-peak hours, when patronage is low," KMB's

principal engineer, Kane Shum Yuet-hung, said. The new model has an intelligent

gearbox that adjusts automatically to the best shift under different road

environments and changes in loading, while its air conditioning adjusts every

four seconds. The new model costs about HK$2.5 million - cheaper than the

average price of HK$3 million for three-axle buses, but its mass production will

have to wait until the first model completes road testing in the next three

quarters of this year. New World First Bus also plans to introduce the same

model next month. Meanwhile, KMB insists it has no plans to increase fares in

the near future. Bus companies can make a fare rise application when a formula

consisting of figures on wage-index changes, the composite consumer price index

and the company's productivity gain calculate to an outcome higher than 2 per

cent. KMB managing director Edmond Ho Tat-man said the latest calculation -

taking into account last July's salary increase for bus drivers - gave an

outcome of just 0.59 per cent. "At present, we have no plan to raise fares," Ho

said. "If we can rationalise more bus routes, it would further ease our pressure

for a fare rise." The Environment Bureau is consulting the public over an air

quality objective that includes 19 proposals to improve the city's air quality.

They include bus route rationalization and quicker replacement of old bus models

- which officials estimate may push bus fares up by 15 per cent. A typical two-axle double-decker which

will be introduced by Kowloon Motor Bus next month to save costs and to protect

the environment. The new model meets Euro V emission standards. Kowloon Motor

Bus will introduce a new two-axle double-decker in a bid to cut costs and reduce

pollution. The new model, to be introduced next month during non-peak hours,

meets the Euro V emission standard, which means it releases at least 40 per cent

less nitrogen oxide emissions than most buses on the road. Most Hong Kong buses

are 12-metre double-deckers with three axles. The two-axle buses are not only

cleaner but are more cost efficient. However, they do have a smaller capacity of

88 passengers, compared to over 140 for larger models. "We could deploy these

smaller and greener buses during non-peak hours, when patronage is low," KMB's

principal engineer, Kane Shum Yuet-hung, said. The new model has an intelligent

gearbox that adjusts automatically to the best shift under different road

environments and changes in loading, while its air conditioning adjusts every

four seconds. The new model costs about HK$2.5 million - cheaper than the

average price of HK$3 million for three-axle buses, but its mass production will

have to wait until the first model completes road testing in the next three

quarters of this year. New World First Bus also plans to introduce the same

model next month. Meanwhile, KMB insists it has no plans to increase fares in

the near future. Bus companies can make a fare rise application when a formula

consisting of figures on wage-index changes, the composite consumer price index

and the company's productivity gain calculate to an outcome higher than 2 per

cent. KMB managing director Edmond Ho Tat-man said the latest calculation -

taking into account last July's salary increase for bus drivers - gave an

outcome of just 0.59 per cent. "At present, we have no plan to raise fares," Ho

said. "If we can rationalise more bus routes, it would further ease our pressure

for a fare rise." The Environment Bureau is consulting the public over an air

quality objective that includes 19 proposals to improve the city's air quality.

They include bus route rationalization and quicker replacement of old bus models

- which officials estimate may push bus fares up by 15 per cent.

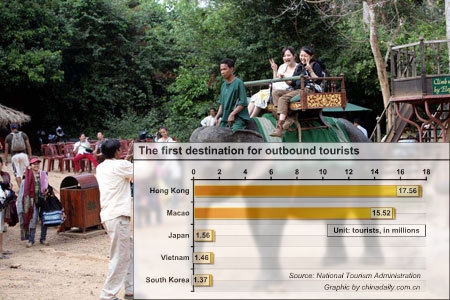

Harbor City in Tsim Sha

Tsui expects double-digit growth in Lunar New Year sales from improving

sentiment and mainland tourists. Shopping centre operators in the city are

forecasting double-digit sales growth over the Lunar New Year to be fuelled by

mainland tourists continuing their buying spree. With just less than three weeks

to go before the festival, Maureen Fung Sau-yim, the general manager for leasing

at Sun Hung Kai Real Estate Agency, expects the firm's 12 shopping centres to

have 11.7 million customers in the build-up to the holiday. This would boost

turnover by more than 13 per cent to HK$240 million for the period, she said. At

Sun Hung Kai's apm mall in Kwun Tong, operators plan to organise 30 themed

shopping tours, such as "wedding tours", "property purchasing and shopping

tours" and "hotel guest shopping tours". Fung estimated they would attract about

1,500 people who would be spending an average of HK$3,000 to HK$3,500 per

person. Harbour City shopping arcade in Tsim Sha Tsui, one of the city's

largest, also hopes to see double-digit growth for the period. Canis Lee Lai-yi,

an assistant general manager of leasing at Harbour City, said buying sentiment

rebounded quickly in the second half of last year, as consumers had saved money

during the financial crisis and the human swine flu outbreak. The shopping

centre's annual turnover surged 16 per cent to HK$15.5 billion last year, with

average turnover per square metre rising to a record HK$2,384 in December. Lee

said mainland shoppers contributed significantly to those figures, with HK$5.3

billion of retail sales being settled by the mainland's electronic payment

network China Union Pay last year, up 65 per cent from HK$3.2 billion a year

earlier. The amount represents about an eighth of the HK$42 billion total paid

by China Union Pay cards in Hong Kong last year. The shopping arcade had an

occupancy rate of 98 per cent, with the remainder under renovation, Lee said.

She also expected double-digit growth in rents this year. Tenants are paying a

base rent ranging from HK$200 to HK$600 per square foot. Official data shows the

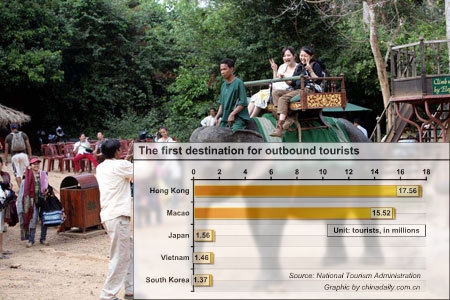

city had about 18 million mainland visitors last year, up 6.5 per cent from

2008. A further 7.5 per cent rise is expected this year. Harbor City in Tsim Sha

Tsui expects double-digit growth in Lunar New Year sales from improving

sentiment and mainland tourists. Shopping centre operators in the city are

forecasting double-digit sales growth over the Lunar New Year to be fuelled by

mainland tourists continuing their buying spree. With just less than three weeks

to go before the festival, Maureen Fung Sau-yim, the general manager for leasing

at Sun Hung Kai Real Estate Agency, expects the firm's 12 shopping centres to

have 11.7 million customers in the build-up to the holiday. This would boost

turnover by more than 13 per cent to HK$240 million for the period, she said. At

Sun Hung Kai's apm mall in Kwun Tong, operators plan to organise 30 themed

shopping tours, such as "wedding tours", "property purchasing and shopping

tours" and "hotel guest shopping tours". Fung estimated they would attract about

1,500 people who would be spending an average of HK$3,000 to HK$3,500 per

person. Harbour City shopping arcade in Tsim Sha Tsui, one of the city's

largest, also hopes to see double-digit growth for the period. Canis Lee Lai-yi,

an assistant general manager of leasing at Harbour City, said buying sentiment

rebounded quickly in the second half of last year, as consumers had saved money

during the financial crisis and the human swine flu outbreak. The shopping

centre's annual turnover surged 16 per cent to HK$15.5 billion last year, with

average turnover per square metre rising to a record HK$2,384 in December. Lee

said mainland shoppers contributed significantly to those figures, with HK$5.3

billion of retail sales being settled by the mainland's electronic payment

network China Union Pay last year, up 65 per cent from HK$3.2 billion a year

earlier. The amount represents about an eighth of the HK$42 billion total paid

by China Union Pay cards in Hong Kong last year. The shopping arcade had an

occupancy rate of 98 per cent, with the remainder under renovation, Lee said.

She also expected double-digit growth in rents this year. Tenants are paying a

base rent ranging from HK$200 to HK$600 per square foot. Official data shows the

city had about 18 million mainland visitors last year, up 6.5 per cent from

2008. A further 7.5 per cent rise is expected this year.

The Hospital Authority revealed for

the first time that it needs 600 nurses, but the nurses union said the figure

was arbitrary and would not solve the manpower shortage.

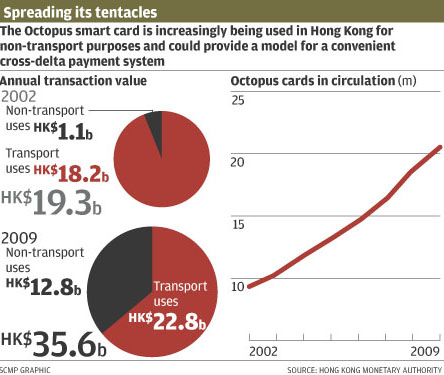

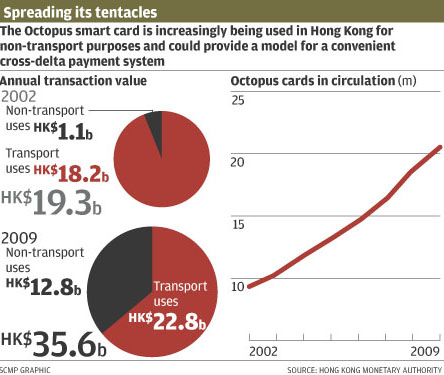

Single smart card to cover HK and

Shenzhen purchases later this year - Millions of commuters in Hong Kong and

Shenzhen will be able to use a single stored-value card to pay public transport

fares and make small-value purchases in the two cities starting later this year.

A card with two chips - integrating the Octopus card and the Shenzhen Tong smart

card - will be introduced, Hong Kong Monetary Authority chief executive Norman

Chan Tak-lam said yesterday. The use of cash-free transactions would in future

be expanded to the entire Pearl River Delta region, he said. Speaking at a forum

on integration between Hong Kong and the Delta region, Chan said a "two-in-one

card", with chips for the Octopus card and Shenzhen Tong, was technically

simple. "But there is a need to issue new cards and tackle the issue of value

uploading involving different currencies," he said. Another feasible proposal

would be development of a common card reader for use in Shenzhen and Hong Kong,

including the Octopus card, Shenzhen Tong and Shenzhen Bank Card. There are more

than 20 million Octopus cards in circulation in Hong Kong, while 6.5 million

Shenzhen Tong cards have been issued. More than HK$90 million worth of

transactions are made each day with Octopus cards, but they are accepted only at

11 fast food outlets in Shenzhen and four duty-free shops at the Lo Wu and

Huanggang control points. Chan said mutual use of e-money in Hong Kong and the

delta region would be conducive to creating a world-class Pearl River Delta

metropolis. Tan Gang, vice-president of Shenzhen-based think tank the China

Development Institute, said integration of stored-value cards would bring huge

convenience for cross-border travellers. "It will encourage more Shenzhen

residents to travel to Hong Kong and stimulate consumption there," he said. "It

will also serve as a new platform for further co-operation between Hong Kong and

Shenzhen." Visitors to Hong Kong from the mainland are among the top spenders,

parting with an average of HK$5,676 last year, compared with HK$5,439 overall

for overnight visitors, HK$2,138 for same-day visitors and HK$1,498 for all

visitors, according to the Hong Kong Tourism Board. Octopus Holdings has been

studying a possible merger with the Shenzhen smart card since 2008, but little

progress has been made due to technical and operational obstacles, while there

are also concerns over currency exchange. The company's chief executive,

Prudence Chan Bik-wah, said last year that putting both chips in one card could

cause the systems to interfere with one another. But a company spokeswoman said

there had been breakthroughs. "We still need to perform tests over the next few

months on the new card's technical viability." Single smart card to cover HK and

Shenzhen purchases later this year - Millions of commuters in Hong Kong and

Shenzhen will be able to use a single stored-value card to pay public transport

fares and make small-value purchases in the two cities starting later this year.

A card with two chips - integrating the Octopus card and the Shenzhen Tong smart

card - will be introduced, Hong Kong Monetary Authority chief executive Norman

Chan Tak-lam said yesterday. The use of cash-free transactions would in future

be expanded to the entire Pearl River Delta region, he said. Speaking at a forum

on integration between Hong Kong and the Delta region, Chan said a "two-in-one

card", with chips for the Octopus card and Shenzhen Tong, was technically

simple. "But there is a need to issue new cards and tackle the issue of value

uploading involving different currencies," he said. Another feasible proposal

would be development of a common card reader for use in Shenzhen and Hong Kong,

including the Octopus card, Shenzhen Tong and Shenzhen Bank Card. There are more

than 20 million Octopus cards in circulation in Hong Kong, while 6.5 million

Shenzhen Tong cards have been issued. More than HK$90 million worth of

transactions are made each day with Octopus cards, but they are accepted only at

11 fast food outlets in Shenzhen and four duty-free shops at the Lo Wu and

Huanggang control points. Chan said mutual use of e-money in Hong Kong and the

delta region would be conducive to creating a world-class Pearl River Delta

metropolis. Tan Gang, vice-president of Shenzhen-based think tank the China

Development Institute, said integration of stored-value cards would bring huge

convenience for cross-border travellers. "It will encourage more Shenzhen

residents to travel to Hong Kong and stimulate consumption there," he said. "It

will also serve as a new platform for further co-operation between Hong Kong and

Shenzhen." Visitors to Hong Kong from the mainland are among the top spenders,

parting with an average of HK$5,676 last year, compared with HK$5,439 overall

for overnight visitors, HK$2,138 for same-day visitors and HK$1,498 for all

visitors, according to the Hong Kong Tourism Board. Octopus Holdings has been

studying a possible merger with the Shenzhen smart card since 2008, but little

progress has been made due to technical and operational obstacles, while there

are also concerns over currency exchange. The company's chief executive,

Prudence Chan Bik-wah, said last year that putting both chips in one card could

cause the systems to interfere with one another. But a company spokeswoman said

there had been breakthroughs. "We still need to perform tests over the next few

months on the new card's technical viability."

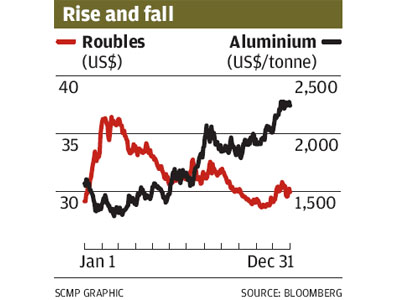

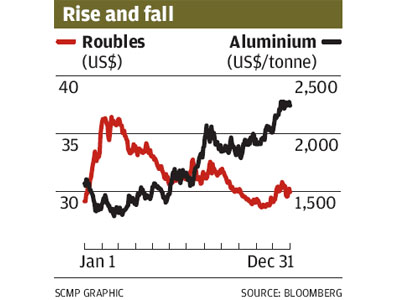

Rusal chief executive Oleg

Deripaska toast with Ronald Arculli, chairman of the Hong Kong Stock Exchange,

during the Russian company's listing debut at the Hong Kong stock exchange on

Wednesday. Russian metals giant Rusal plunged on its Hong Kong stock market

debut on Wednesday but the controversial firm’s boss expressed confidence about

tapping the resources-hungry mainland market. The world’s largest aluminium

producer closed at HK$9.66 per share, a 10.56 per cent fall from its initial

public offering (IPO) price of HK$10.80. Rusal chief executive Oleg Deripaska

told reporters the listing price, which was at a premium to rivals in the

sector, was “reasonable”. “You see what’s happening in markets all over the

world,” the 42-year-old, who is dogged by unproven allegations that he has links

to organised crime, told reporters at the Hong Kong exchange. The billionaire

oligarch – once Russia’s richest man before metals prices plummeted last year in

the global financial crisis – said debt-laden Rusal was a good long-term bet as

it taps the fast-growing market in mainland. “We believe in the growth in Asia,”

he said. “This company is best in class.” Moscow-based Rusal became the first

Russian firm to list in Hong Kong. Its IPO, worth US$2.2 billion, was the city’s

biggest by a company from outside Asia. “We believe this is the first step –

there will be more Russian companies on the Hong Kong Stock Exchange,” Deripaska

said. “More Russian money will come into Hong Kong.” But Howard Gorges,

vice-chairman of Hong Kong-based South China Securities, said Rusal’s prospects

could be dim, noting that its trading debut tumble was “a warning to punters”.

“Just because the company is listed now, I don’t think it means a lot of people

will be rushing into it,” he said. “Rusal has had a cloud hanging over it.”

Controversy swirled around Rusal’s share sale after the exchange repeatedly

delayed approving its IPO amid concerns about its huge debt of US$15 billion. In

a highly unusual move, the city’s Securities and Futures Commission effectively

restricted the IPO to institutions and so-called professional investors by

mandating a minimum investment of about HK$1 million. Rusal reached a deal to

restructure its debts with creditors last year. But its 1,100-page IPO

prospectus outlined a laundry list of possible risks, including potentially

crippling lawsuits, its debts, and even the company’s demise should metals

prices plunge again. Helen Lau, senior research analyst at OSK Asia Holdings,

said Rusal is a low-cost producer that will benefit from stronger demand for

metals. But she warned that its problems are a red-flag for investors,

especially when compared with rivals such the “stable” Aluminum Corp of China (SEHK:

2600). “Rusal does have an attractive upside,” she said. “Hopefully all these

political and legal disputes can be settled as soon as possible.” The state of

Rusal’s balance sheet marks a fall from grace for Deripaska, who was among a

small group of entrepreneurs who scooped up formerly state-owned assets after

the Soviet Union’s collapse in 1991. Among those assets was the Sayansk

aluminium smelter in Siberia, the flashpoint in a bloody feud known as the

“aluminium wars” that saw gangland slayings and private armies battle it out for

control of the sector. In 2004, Deripaska bought out his then-partner, current

Chelsea football club owner Roman Abramovich, and merged Rusal with rival firm

Sual and the aluminium operation of Switzerland-based Glencore. The move created

the world’s biggest aluminium concern in 2006 which now employs 75,000 people in

19 countries, and accounts for 12 per cent of the world’s aluminium output.

Along the way, Deripaska locked horns with fugitive Israeli businessman Michael

Cherney, who is suing him for US$4 billion over a disputed stake in Rusal.

Cherney is wanted by Interpol over Spanish allegations of money-laundering.

Separately, the West African nation of Guinea is suing Rusal for US$1 billion in

damages stemming from a privatisation dispute. Deripaska and Rusal have

dismissed both legal actions as without merit. Rusal chief executive Oleg

Deripaska toast with Ronald Arculli, chairman of the Hong Kong Stock Exchange,

during the Russian company's listing debut at the Hong Kong stock exchange on

Wednesday. Russian metals giant Rusal plunged on its Hong Kong stock market

debut on Wednesday but the controversial firm’s boss expressed confidence about

tapping the resources-hungry mainland market. The world’s largest aluminium

producer closed at HK$9.66 per share, a 10.56 per cent fall from its initial

public offering (IPO) price of HK$10.80. Rusal chief executive Oleg Deripaska

told reporters the listing price, which was at a premium to rivals in the

sector, was “reasonable”. “You see what’s happening in markets all over the

world,” the 42-year-old, who is dogged by unproven allegations that he has links

to organised crime, told reporters at the Hong Kong exchange. The billionaire

oligarch – once Russia’s richest man before metals prices plummeted last year in

the global financial crisis – said debt-laden Rusal was a good long-term bet as

it taps the fast-growing market in mainland. “We believe in the growth in Asia,”

he said. “This company is best in class.” Moscow-based Rusal became the first

Russian firm to list in Hong Kong. Its IPO, worth US$2.2 billion, was the city’s

biggest by a company from outside Asia. “We believe this is the first step –

there will be more Russian companies on the Hong Kong Stock Exchange,” Deripaska

said. “More Russian money will come into Hong Kong.” But Howard Gorges,

vice-chairman of Hong Kong-based South China Securities, said Rusal’s prospects

could be dim, noting that its trading debut tumble was “a warning to punters”.

“Just because the company is listed now, I don’t think it means a lot of people

will be rushing into it,” he said. “Rusal has had a cloud hanging over it.”

Controversy swirled around Rusal’s share sale after the exchange repeatedly

delayed approving its IPO amid concerns about its huge debt of US$15 billion. In

a highly unusual move, the city’s Securities and Futures Commission effectively

restricted the IPO to institutions and so-called professional investors by

mandating a minimum investment of about HK$1 million. Rusal reached a deal to

restructure its debts with creditors last year. But its 1,100-page IPO

prospectus outlined a laundry list of possible risks, including potentially

crippling lawsuits, its debts, and even the company’s demise should metals

prices plunge again. Helen Lau, senior research analyst at OSK Asia Holdings,

said Rusal is a low-cost producer that will benefit from stronger demand for

metals. But she warned that its problems are a red-flag for investors,

especially when compared with rivals such the “stable” Aluminum Corp of China (SEHK:

2600). “Rusal does have an attractive upside,” she said. “Hopefully all these

political and legal disputes can be settled as soon as possible.” The state of

Rusal’s balance sheet marks a fall from grace for Deripaska, who was among a

small group of entrepreneurs who scooped up formerly state-owned assets after

the Soviet Union’s collapse in 1991. Among those assets was the Sayansk

aluminium smelter in Siberia, the flashpoint in a bloody feud known as the

“aluminium wars” that saw gangland slayings and private armies battle it out for

control of the sector. In 2004, Deripaska bought out his then-partner, current

Chelsea football club owner Roman Abramovich, and merged Rusal with rival firm

Sual and the aluminium operation of Switzerland-based Glencore. The move created

the world’s biggest aluminium concern in 2006 which now employs 75,000 people in

19 countries, and accounts for 12 per cent of the world’s aluminium output.

Along the way, Deripaska locked horns with fugitive Israeli businessman Michael

Cherney, who is suing him for US$4 billion over a disputed stake in Rusal.

Cherney is wanted by Interpol over Spanish allegations of money-laundering.

Separately, the West African nation of Guinea is suing Rusal for US$1 billion in

damages stemming from a privatisation dispute. Deripaska and Rusal have

dismissed both legal actions as without merit.

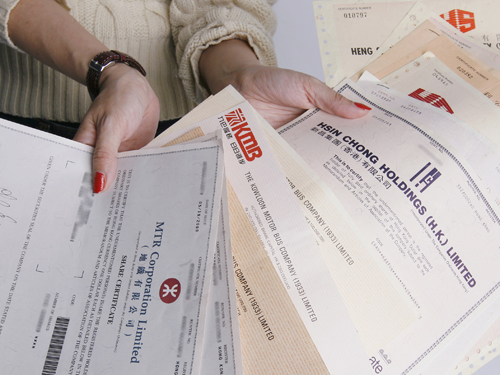

Compulsory en

bloc acquisition of units in old and neglected blocks in Hong Kong for

redevelopment could be sped up by policy changes the government is proposing in

a bid to get rid of buildings that pose "a serious threat to public safety". The

changes are contained in a bill published last week that calls for the

introduction of mandatory inspection every 10 years of buildings that are more

than 30 years old, and mandatory checks on windows in such buildings every five

years. The bill will be debated in the Legislative Council on February 3 and, if

passed, the provisions are likely to take effect late next year. The bill

provides that owners of units in old blocks will be required to engage qualified

inspectors to check their buildings and windows, and to undertake the necessary

repair works specified by the inspectors. The move follows the lowering of the

minimum number of sales acceptances by unit holders to 80 per cent from 90 per

cent before a developer can compulsorily acquire a building more than 50 years

old. The lower threshold will take effect from April this year. Property

analysts say as a result of the changes, more flat owners could consider selling

their units to developers rather than paying for the mandatory repair works.

Tsim Chai-nam, the director of Clerk of Works Services, estimates the inspection

cost at HK$4 to HK$5 per square foot, possibly reaching HK$4,000 per household

if the inspection includes common areas. Repair costs could begin at about

HK$3,000 for the repair of drainage systems, rising to HK$50,000 if external

walls and windows need repair. One occupant of an old building, Chinese medicine

practitioner Kwan Chi-yee, welcomed the proposed mandatory inspections. Kwan

opened a clinic in a 600 square foot flat in a 40-year-old building on Hennessy

Road 20 years ago. "This is a good policy. Many people have been hit by falling

concrete and windows from old buildings in the last few years. The policy can

ensure the safety of pedestrians," he said. But he worries construction firms

and inspectors could raise their fees if the policy is introduced. Sito Lai-jin,

82, who lives alone in a 500 sq ft flat in a building more than 40 years old at

Fuk Wa Street in Sham Shui Po, worries about the plan. "I am retired and have no

income. How can I afford the inspection and maintenance costs? I hope the

government will offer a subsidy," she said. Charles Chan Chiu-kwok, the managing

director of Savills Valuation and Professional Services, says repairs on old

buildings could cost unit owners from HK$10,000 to HK$100,000. He believes the

new policies will encourage flat owners to sell their units rather than pay the

cost of mandatory repairs. "Changing windows and [fixing] drainage will not help

flat owners sell their units at a higher price. Spending on repairs cannot be

offset by gains in property prices," he said. "But flat owners can improve their

living environment by selling their units at a good offer from the developers.

It will also be easier for the flat owners to sell their units after the sale

threshold has been cut to 80 per cent of the total ownerships." Tsim said Clerks

of Works would benefit from the policy changes but he worried flat owners might

suffer. "I expect many construction firms will provide free property inspection

to lure flat owners. They may overstate the problem of the buildings to get more

renovation jobs," he said. Standards were another problem. "Some construction

companies may not fully repair the buildings so if the problems recur, they can

get another job. Thus it is important to monitor the standard of repair works,"

Tsim said. He said most flat owners might be willing to renovate their buildings

in the early stage of discussions. "However, they will have different opinions

when they negotiate the costs. Some will try to lower the costs by cutting some

of the works while others may insist on a complete repair." Compulsory en

bloc acquisition of units in old and neglected blocks in Hong Kong for

redevelopment could be sped up by policy changes the government is proposing in

a bid to get rid of buildings that pose "a serious threat to public safety". The

changes are contained in a bill published last week that calls for the

introduction of mandatory inspection every 10 years of buildings that are more

than 30 years old, and mandatory checks on windows in such buildings every five

years. The bill will be debated in the Legislative Council on February 3 and, if

passed, the provisions are likely to take effect late next year. The bill

provides that owners of units in old blocks will be required to engage qualified

inspectors to check their buildings and windows, and to undertake the necessary

repair works specified by the inspectors. The move follows the lowering of the

minimum number of sales acceptances by unit holders to 80 per cent from 90 per

cent before a developer can compulsorily acquire a building more than 50 years

old. The lower threshold will take effect from April this year. Property

analysts say as a result of the changes, more flat owners could consider selling

their units to developers rather than paying for the mandatory repair works.

Tsim Chai-nam, the director of Clerk of Works Services, estimates the inspection

cost at HK$4 to HK$5 per square foot, possibly reaching HK$4,000 per household

if the inspection includes common areas. Repair costs could begin at about

HK$3,000 for the repair of drainage systems, rising to HK$50,000 if external

walls and windows need repair. One occupant of an old building, Chinese medicine

practitioner Kwan Chi-yee, welcomed the proposed mandatory inspections. Kwan

opened a clinic in a 600 square foot flat in a 40-year-old building on Hennessy

Road 20 years ago. "This is a good policy. Many people have been hit by falling

concrete and windows from old buildings in the last few years. The policy can

ensure the safety of pedestrians," he said. But he worries construction firms

and inspectors could raise their fees if the policy is introduced. Sito Lai-jin,

82, who lives alone in a 500 sq ft flat in a building more than 40 years old at

Fuk Wa Street in Sham Shui Po, worries about the plan. "I am retired and have no

income. How can I afford the inspection and maintenance costs? I hope the

government will offer a subsidy," she said. Charles Chan Chiu-kwok, the managing

director of Savills Valuation and Professional Services, says repairs on old

buildings could cost unit owners from HK$10,000 to HK$100,000. He believes the

new policies will encourage flat owners to sell their units rather than pay the

cost of mandatory repairs. "Changing windows and [fixing] drainage will not help

flat owners sell their units at a higher price. Spending on repairs cannot be

offset by gains in property prices," he said. "But flat owners can improve their

living environment by selling their units at a good offer from the developers.

It will also be easier for the flat owners to sell their units after the sale

threshold has been cut to 80 per cent of the total ownerships." Tsim said Clerks

of Works would benefit from the policy changes but he worried flat owners might

suffer. "I expect many construction firms will provide free property inspection

to lure flat owners. They may overstate the problem of the buildings to get more

renovation jobs," he said. Standards were another problem. "Some construction

companies may not fully repair the buildings so if the problems recur, they can

get another job. Thus it is important to monitor the standard of repair works,"

Tsim said. He said most flat owners might be willing to renovate their buildings

in the early stage of discussions. "However, they will have different opinions

when they negotiate the costs. Some will try to lower the costs by cutting some

of the works while others may insist on a complete repair."

It's a real tough life in HK - If

you think you've got it tough - you have. That's the view of life in Hong Kong

from across the border, where a poll has just put the SAR top of the most

formidable places to live in all of China. Among minuses in the quality of life

seen for white-collar workers here: Work is at breakneck pace because of a fear

you won't make ends meet; Love must take a back seat - and if you are married

the pressures of life can wreck the partnership; and Health is sacrificed in the

chase to earn. The grim views from the mainland comes with a poll by Xinhuanet,

an online arm of the national news agency. Hong Kong is "the most toilsome" of

Chinese cities, ahead of Suzhou, Shenzhen, Taipei, Guangzhou and Shanghai. With

the unenviable ranking are jarring remarks about the place Xinhuanet says merits

the "vibrant and dynamic" tag, though for plenty of wrong reasons. "Working

overtime is a catchword of the Hong Kong people," it says, and "very few people

shop around during working hours. The streets are usually packed with mainland

tourists." The turnover rate of the labor force is high - in part due to mass

layoffs and fierce wars for talent among companies. Although people are plugged

up with earphones, it goes on, many workers do not have time to watch

television, but wives could well be TV junkies. Nor is there time to seek true

love, resulting in a drop in the number of marriages and a higher rate of

divorce. "The trend is that single women live together while men want to get

married," it says. Health is another casualty in the money chase. The more

people work the less often they work out. There's certainly no time to enjoy a

good meal - reflected in the spread of fast-food joints. Although Xinhuanet

fails to give details of the method and size of its poll, an associate professor

of sociology at the Chinese University of Hong Kong does not find the message

surprising. "Hong Kong's economy has been developing far longer than most

mainland cities," Chan Hoi-man says. "People here generally have to face complex

problems at work and suffer enormous pressure." Hong Kong is more comparable

with cities such as Tokyo and New York, he added, while the living standard is

generally higher than in mainland cities. And as for the promotion of a five-day

week, that does not help much as the workload of most people is as heavy as

ever. Leung Hon-chu, a principal lecturer in sociology at Baptist University,

goes along with views that job security is lacking and workers tend to use every

chance to earn more money. Indeed, Leung says, there's no time to enjoy life. It's a real tough life in HK - If

you think you've got it tough - you have. That's the view of life in Hong Kong

from across the border, where a poll has just put the SAR top of the most

formidable places to live in all of China. Among minuses in the quality of life

seen for white-collar workers here: Work is at breakneck pace because of a fear

you won't make ends meet; Love must take a back seat - and if you are married

the pressures of life can wreck the partnership; and Health is sacrificed in the

chase to earn. The grim views from the mainland comes with a poll by Xinhuanet,

an online arm of the national news agency. Hong Kong is "the most toilsome" of

Chinese cities, ahead of Suzhou, Shenzhen, Taipei, Guangzhou and Shanghai. With

the unenviable ranking are jarring remarks about the place Xinhuanet says merits

the "vibrant and dynamic" tag, though for plenty of wrong reasons. "Working

overtime is a catchword of the Hong Kong people," it says, and "very few people

shop around during working hours. The streets are usually packed with mainland

tourists." The turnover rate of the labor force is high - in part due to mass

layoffs and fierce wars for talent among companies. Although people are plugged

up with earphones, it goes on, many workers do not have time to watch

television, but wives could well be TV junkies. Nor is there time to seek true

love, resulting in a drop in the number of marriages and a higher rate of

divorce. "The trend is that single women live together while men want to get

married," it says. Health is another casualty in the money chase. The more

people work the less often they work out. There's certainly no time to enjoy a

good meal - reflected in the spread of fast-food joints. Although Xinhuanet

fails to give details of the method and size of its poll, an associate professor

of sociology at the Chinese University of Hong Kong does not find the message

surprising. "Hong Kong's economy has been developing far longer than most

mainland cities," Chan Hoi-man says. "People here generally have to face complex

problems at work and suffer enormous pressure." Hong Kong is more comparable

with cities such as Tokyo and New York, he added, while the living standard is

generally higher than in mainland cities. And as for the promotion of a five-day

week, that does not help much as the workload of most people is as heavy as

ever. Leung Hon-chu, a principal lecturer in sociology at Baptist University,

goes along with views that job security is lacking and workers tend to use every

chance to earn more money. Indeed, Leung says, there's no time to enjoy life.

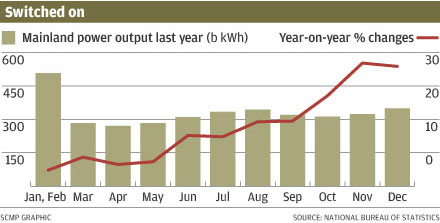

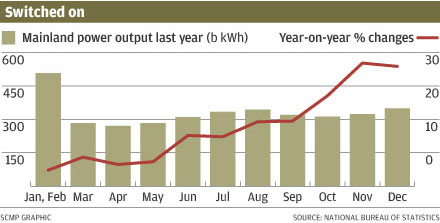

China*: China

has centralized its energy strategy within a new government agency launched on

Wednesday, aiming to co-ordinate policy-making that previously was shaped by a

tangle of agencies. Premier Wen Jiabao will be the head of agency and

Vice-Premier Li Keqiang will be the deputy, according a central government

notice. “The National Energy Committee (NEC) is established to step up energy

strategic decision-making, overall planning and coordination,” the central

government said in a notice published on its website (www.gov.cn) It is

responsible for working out national energy development strategy, reviewing

energy security and major energy issues as well as planning domestic energy

development and international cooperation, it added. Mainland’s plan to create a

“super ministry” to steer the energy sector was put on hold in 2008 due to the

difficulty of reaching a consensus between big energy firms and existing energy

agencies. Instead, the national parliament approved the establishment of the

National Energy Administration (NEA) and the NEC in early 2008. The NEA was

officially launched in July 2008, but still lacks real power to carry out many

of its assigned tasks as responsibility for the energy sector is currently

dispersed among a number of departments. The NEC committee has 21 members,

consisting mainly of ministers from a wide range of ministries such as the

Finance Ministry, the Commerce Ministry and the central bank. Zhang Ping, head

of the National Development and Reform Commission, will work as the head of

NEC’s general affairs office while Zhang Guobao, head of NEA, will act as Zhang

Ping’s deputy in NEC. The NEA will also be responsible for handling specific

works of NEC, according to the notice. Analysts said that the launch of the

committee is aimed at creating an authoritative body to better organise the

scattering power distributed between different ministries.

China*: China

has centralized its energy strategy within a new government agency launched on

Wednesday, aiming to co-ordinate policy-making that previously was shaped by a

tangle of agencies. Premier Wen Jiabao will be the head of agency and

Vice-Premier Li Keqiang will be the deputy, according a central government

notice. “The National Energy Committee (NEC) is established to step up energy

strategic decision-making, overall planning and coordination,” the central

government said in a notice published on its website (www.gov.cn) It is

responsible for working out national energy development strategy, reviewing

energy security and major energy issues as well as planning domestic energy

development and international cooperation, it added. Mainland’s plan to create a

“super ministry” to steer the energy sector was put on hold in 2008 due to the

difficulty of reaching a consensus between big energy firms and existing energy

agencies. Instead, the national parliament approved the establishment of the

National Energy Administration (NEA) and the NEC in early 2008. The NEA was

officially launched in July 2008, but still lacks real power to carry out many

of its assigned tasks as responsibility for the energy sector is currently

dispersed among a number of departments. The NEC committee has 21 members,

consisting mainly of ministers from a wide range of ministries such as the

Finance Ministry, the Commerce Ministry and the central bank. Zhang Ping, head

of the National Development and Reform Commission, will work as the head of

NEC’s general affairs office while Zhang Guobao, head of NEA, will act as Zhang

Ping’s deputy in NEC. The NEA will also be responsible for handling specific

works of NEC, according to the notice. Analysts said that the launch of the

committee is aimed at creating an authoritative body to better organise the

scattering power distributed between different ministries.

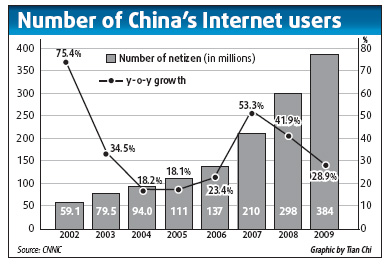

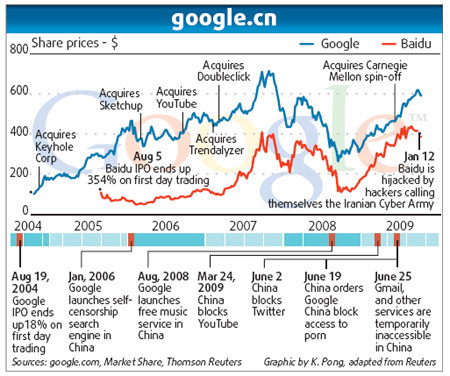

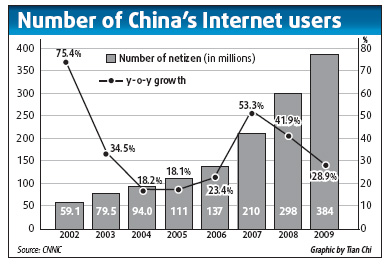

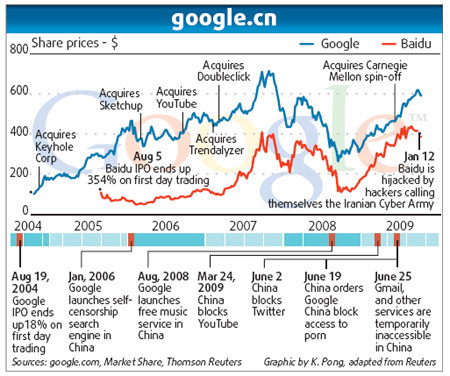

Gates: Net curbs in China very limited -

Microsoft Corp chairman Bill Gates has described Beijing's efforts to censor the

Internet as "very limited", saying corporations which operate in China should

abide by the local law. In an interview on ABC's Good Morning America on Monday

about Google's dispute with China, Gates said the Internet is subject to

different kinds of censorship around the world, noting that Germany forbids

pro-Nazi statements that would be protected as free speech in the United States.

"And you've got to decide: Do you want to obey the laws of the countries you're

in, or not? If not, you may not end up doing business there," Gates, the world's

richest man, said without mentioning the search engine giant by name. "The

Chinese efforts to censor the Internet have been very limited and so I think

keeping the Internet thriving there is very important." He declared he was

unimpressed and a bit perplexed by Google's recent threat to shut down its

operations in China, citing disagreements with government policies and

unspecified attacks. One may or may not agree with the laws in China, Gates

said, but nearly all countries have some controversial laws or policies,

including the United States. "What point are they making?" Gates asked. "Now, if

Google ever chooses to pull out of the United States, then I'd give them

credit." Google is currently in delicate negotiations with the Chinese

government to continue its presence in the world's most populous Internet

market. Its top lawyer said on Monday that the issue would probably be resolved

in weeks, but cautioned it could take months. Google's complaints have received

backing from the White House with Washington soon raising Internet freedom to

the level of a major facet of its human rights agenda. Beijing has tried hard to

play down the row with Washington over the issue, insisting that the Google case

is just a legal and technical matter that should not be linked to bilateral

ties. Observers agree with Gates' remarks on following local rules, noting the

US bans child pornography while France bans Internet access to Nazi imagery. Fan

Jishe, a scholar in US studies at the Chinese Academy of Social Sciences, said

every country has its own way of online supervision. He said the Google dispute

is only an excuse for the Obama administration to criticize China on Internet

freedom. He said even if the Google issue had not come to the fore, Obama would

have exerted pressure on Internet freedom sooner or later. He noted that Obama

had held up the United States as a model of free flow of information during his

visit to Shanghai last year. He Jingchu, a professor at Southwest University of

Political Science and Law said in an article yesterday that Obama's

over-interpretation of the issue is aimed at diverting domestic attention from

his unsatisfactory political achievements to the Sino-US relationship, the

world's most important. Gates: Net curbs in China very limited -

Microsoft Corp chairman Bill Gates has described Beijing's efforts to censor the

Internet as "very limited", saying corporations which operate in China should

abide by the local law. In an interview on ABC's Good Morning America on Monday

about Google's dispute with China, Gates said the Internet is subject to

different kinds of censorship around the world, noting that Germany forbids

pro-Nazi statements that would be protected as free speech in the United States.

"And you've got to decide: Do you want to obey the laws of the countries you're

in, or not? If not, you may not end up doing business there," Gates, the world's

richest man, said without mentioning the search engine giant by name. "The

Chinese efforts to censor the Internet have been very limited and so I think

keeping the Internet thriving there is very important." He declared he was

unimpressed and a bit perplexed by Google's recent threat to shut down its

operations in China, citing disagreements with government policies and

unspecified attacks. One may or may not agree with the laws in China, Gates

said, but nearly all countries have some controversial laws or policies,

including the United States. "What point are they making?" Gates asked. "Now, if

Google ever chooses to pull out of the United States, then I'd give them

credit." Google is currently in delicate negotiations with the Chinese

government to continue its presence in the world's most populous Internet

market. Its top lawyer said on Monday that the issue would probably be resolved

in weeks, but cautioned it could take months. Google's complaints have received

backing from the White House with Washington soon raising Internet freedom to

the level of a major facet of its human rights agenda. Beijing has tried hard to

play down the row with Washington over the issue, insisting that the Google case

is just a legal and technical matter that should not be linked to bilateral

ties. Observers agree with Gates' remarks on following local rules, noting the

US bans child pornography while France bans Internet access to Nazi imagery. Fan

Jishe, a scholar in US studies at the Chinese Academy of Social Sciences, said

every country has its own way of online supervision. He said the Google dispute

is only an excuse for the Obama administration to criticize China on Internet

freedom. He said even if the Google issue had not come to the fore, Obama would

have exerted pressure on Internet freedom sooner or later. He noted that Obama

had held up the United States as a model of free flow of information during his

visit to Shanghai last year. He Jingchu, a professor at Southwest University of

Political Science and Law said in an article yesterday that Obama's

over-interpretation of the issue is aimed at diverting domestic attention from

his unsatisfactory political achievements to the Sino-US relationship, the

world's most important.

Li Na reacts after

beating Venus Williams at the women's quarterfinals at the Australian Open in

Melbourne on Wednesday. Li Na has set her sights on breaking into the world's

top five after stunning sixth seeded Venus Williams in the quarter-finals of the

Australian Open on Wednesday. Sixteenth seed Li made it two Chinese players into

the semi-finals when she came from a set down to upset Williams 2-6, 7-6 (7/4),

7-5 in an error-strewn match. She will now face either defending champion Serena

Williams or Belarusian seventh seed Victoria Azarenka for a place in the final

after seeing off Williams in two hours, 45 minutes on Rod Laver Arena. “It’s the

best day of my whole life,” an exuberant Li, who joins countrywomam Zheng Jie in

the final four, said. “It’s good for both players and it’s good for Chinese

tennis.” The 17th ranked Li set herself a goal for this year of breaking into

the top 10, and will now achieve that ranking after reaching the semi-finals.

“It’s so exciting, maybe I’ll have a beer tonight,” a smiling Li said. “I don’t

know, because the goal, my goal this year was top 10, but now it’s only January,

so, it’s come quickly.” When asked whether she will dream about reaching the top

five she replied: “Maybe – why not?” Li and Williams made 110 unforced errors

between them in a poor quality match that will be best remembered for the drama

of the fluctuating third set, which featured nine breaks of serve. Li started

nervously and seemed overwhelmed by the occasion as she wilted badly in the

first set against the power of the American. She was broken in her first two

service games and although she managed to get one back, Williams broke once more

at 5-2 to take the first set in only 30 minutes. The start of the second set

followed a similar pattern but things changed at 2-4 when Li suddenly began to

play with far greater freedom. Williams tightened up as her forehand went to

pieces and she was broken twice, the second time when serving for the match at

5-4. Li pounced in the tiebreak to level the match as a nervous Williams came up

with a host of unforced errors. “Actually I was nervous in the first set, I

mean, Venus played aggressively in the first set,” Li said. “She didn’t miss a

lot of balls. I was feeling more pressure in the first set. Then in the second

set I was feeling a little bit better, but still was like 5-3 down. Then I just

tried to get more balls back.” Li’s tiebreak win signalled the start of a

see-sawing final set in which both players struggled to hold serve – at one

stage there were six consecutive breaks. Li finally held and came out to serve

for the match, only to be broken, but Williams dropped her serve straight away,

giving Li another chance. This time she made no mistake as another unforced

error from the American gave her the match. Li, who started her sporting career

in a Chinese badminton program but was told by her coach to give tennis a try,

has now beaten two top 10 players in a row following her fourth round win over

over fourth seed Caroline Wozniacki. It was also her second win in as many

matches against Williams – she beat her in straight sets at the Beijing

Olympics. Williams gave her credit. “Obviously, I think I was playing good

tennis – I don’t think it has anything to do with whether I was playing good,”

she said. “I have to give her a lot of credit for playing well and picking her

game up.” Li Na reacts after

beating Venus Williams at the women's quarterfinals at the Australian Open in

Melbourne on Wednesday. Li Na has set her sights on breaking into the world's

top five after stunning sixth seeded Venus Williams in the quarter-finals of the

Australian Open on Wednesday. Sixteenth seed Li made it two Chinese players into

the semi-finals when she came from a set down to upset Williams 2-6, 7-6 (7/4),

7-5 in an error-strewn match. She will now face either defending champion Serena

Williams or Belarusian seventh seed Victoria Azarenka for a place in the final

after seeing off Williams in two hours, 45 minutes on Rod Laver Arena. “It’s the

best day of my whole life,” an exuberant Li, who joins countrywomam Zheng Jie in

the final four, said. “It’s good for both players and it’s good for Chinese

tennis.” The 17th ranked Li set herself a goal for this year of breaking into

the top 10, and will now achieve that ranking after reaching the semi-finals.

“It’s so exciting, maybe I’ll have a beer tonight,” a smiling Li said. “I don’t

know, because the goal, my goal this year was top 10, but now it’s only January,

so, it’s come quickly.” When asked whether she will dream about reaching the top

five she replied: “Maybe – why not?” Li and Williams made 110 unforced errors

between them in a poor quality match that will be best remembered for the drama

of the fluctuating third set, which featured nine breaks of serve. Li started

nervously and seemed overwhelmed by the occasion as she wilted badly in the

first set against the power of the American. She was broken in her first two

service games and although she managed to get one back, Williams broke once more

at 5-2 to take the first set in only 30 minutes. The start of the second set

followed a similar pattern but things changed at 2-4 when Li suddenly began to

play with far greater freedom. Williams tightened up as her forehand went to

pieces and she was broken twice, the second time when serving for the match at

5-4. Li pounced in the tiebreak to level the match as a nervous Williams came up

with a host of unforced errors. “Actually I was nervous in the first set, I

mean, Venus played aggressively in the first set,” Li said. “She didn’t miss a

lot of balls. I was feeling more pressure in the first set. Then in the second

set I was feeling a little bit better, but still was like 5-3 down. Then I just

tried to get more balls back.” Li’s tiebreak win signalled the start of a

see-sawing final set in which both players struggled to hold serve – at one

stage there were six consecutive breaks. Li finally held and came out to serve

for the match, only to be broken, but Williams dropped her serve straight away,

giving Li another chance. This time she made no mistake as another unforced

error from the American gave her the match. Li, who started her sporting career

in a Chinese badminton program but was told by her coach to give tennis a try,

has now beaten two top 10 players in a row following her fourth round win over

over fourth seed Caroline Wozniacki. It was also her second win in as many

matches against Williams – she beat her in straight sets at the Beijing

Olympics. Williams gave her credit. “Obviously, I think I was playing good

tennis – I don’t think it has anything to do with whether I was playing good,”

she said. “I have to give her a lot of credit for playing well and picking her

game up.”

China sought to head off concerns

about curbs on Google phone technology on Wednesday, as US business groups urged

Washington to tackle "alarming" measures against foreign high-tech companies in

China. Google’s threat to quit China this month over hacking and US criticism of

China’s internet censorship has irritated ties between the two economic giants,

already hurt by disagreements over currency exchange, trade and US arms sales to

Taiwan. In soothing words for investors, a mainland official said Beijing would

not seek to stand in the way of Google’s Android mobile phone platform in the

mainland market. The spokesman for China’s Ministry of Industry and Information

Technology, Zhu Hongren, was responding to a question about whether use of the

Android application in China would be affected by the Internet giant’s

complaints against China. “I think there should be no limit on the use of any

system as long as it complies with regulations in China, it has sound

negotiations and co-operation with telecom operators and obeys relevant rules

and requirement,” Zhu told a news conference. “The Chinese telecommunication

market is an open market.” The ministry oversees China’s mobile telephone

sector. Zhu’s remarks appeared to underscore that the Chinese government does

not want to scare investors by directly attacking Google, and is instead

directing its ire at the US government, which state-run newspapers have accused

of “politicising” the dispute. Two weeks ago, Google threatened to shut its

Chinese Google.cn portal and pull back from China, citing problems of censorship

and a hacking attack from within the country. It is still filtering sensitive

content on Google.cn. The Obama administration backed Google’s criticisms. Last

Thursday US Secretary of State Hillary Clinton urged China to drop Internet

censorship and investigate the hacking. US business groups have fired their own

broadside at China, calling on top US officials to pressure Beijing on moves to

keep out foreign high-tech companies. The appeal, in a letter to top US

officials including Clinton, comes as China formulates regulations for policies

meant to encourage domestic industry to ascend the value chain. Foreign industry

fears that incentives for government purchasers to prioritise domestically

developed products could lose them valuable contracts. “For several years, the

Chinese government has been implementing indigenous innovation policies aimed at

carving out markets for national champions and increasing the locally owned and

developed intellectual property of innovative products,” the business groups

said, according to a text made public by the Business Software alliance. “We are

increasingly alarmed by the means China is using to achieve these goals.”

Signatories urged the Obama administration to make the issue a top priority and

work with the business community and foreign governments to develop a “strong,

fully co-ordinated response to the Chinese government.” A showdown between

Google and the Chinese government could possibly hurt mobile phone makers who

had bet on the Android system to increase sales in the world’s biggest mobile

market. Motorola has bet its turnaround on Google’s mobile software and China.

Phones running on Android, an open-software platform for mobile applications,

are also being developed by several Chinese firms, including ZTE (SEHK: 0763)

Corporation and Huawei. Last week, Google postponed the launch of two mobile

phones in China that use its Android platform. After first fending off

criticisms from Google and Washington, Chinese officials and state-run media

have launched toughly-worded warnings to the Obama administration that have the

hallmarks of a concerted counter-campaign. The People’s Daily, the main

mouthpiece of China’s ruling Communist Party, said on Wednesday that the Google

dispute had added to strains that have created a rocky start for China-US

relations this year. “All of this means that Sino-US relations face severe

challenges,” said the paper. It said the worries included US arms sales to

Taiwan, trade, and speculation that President Barack Obama may meet exiled

Tibetan leader the Dalai Lama. “If these issues are mishandled, they will have a

powerful destructive effect on Sino-US relations, and may even affect the

broader development of relations.”

Greece is wooing mainland to buy up

to €25 billion (HK$274 billion) of its bonds in its efforts to avert one of

Europe’s biggest debt crises, two newspaper reported on Wednesday.

China, Switzerland voice

opposition against trade protectionism - Chinese Vice Premier Li Keqiang(4th L)

attends the joint press conference with President of the Swiss Confederation

Doris Leuthard(4th R) in Bern, capital of Switzerland, on Jan. 26, 2010. Li

Keqiang arrived in Zurich on Monday, kicking off his formal visit to

Switzerland. China, Switzerland voice

opposition against trade protectionism - Chinese Vice Premier Li Keqiang(4th L)

attends the joint press conference with President of the Swiss Confederation

Doris Leuthard(4th R) in Bern, capital of Switzerland, on Jan. 26, 2010. Li

Keqiang arrived in Zurich on Monday, kicking off his formal visit to

Switzerland.

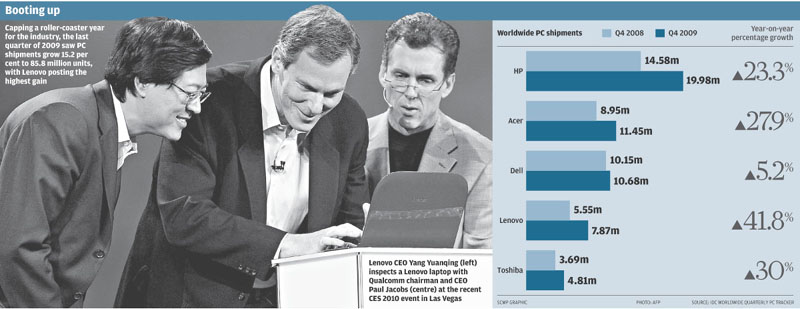

XAIC

extends contract with Boeing - A Boeing 737 aircraft parked at Jinan Yaoqiang

International Airport. The deal will help XAIC in its efforts to become a

strategic partner for Boeing. Xi'an Aircraft International Corporation (XAIC)

yesterday delivered the 1,500th vertical fin for Boeing's best-selling B737

aircraft and signed an extended contract to supply another 1,500 units to the US

aircraft manufacturer. The new order is the largest subcontracting agreement in

terms of volume the Chinese aviation manufacturing industry has ever received.

"The extension of the contract showed that XAIC is capable of producing

large-size aircraft components in large volume for leading international

aviation manufacturers. It is a milestone in XAIC's efforts to become a

strategic partner for Boeing and Airbus," said Meng Xiangkai, president of XAIC.

Vertical fins are typically found on the aft end of the fuselage and are

intended to reduce aerodynamic sideslip. XAIC, a subsidiary of Aviation Industry

Corporation of China (AVIC), signed the first contract for producing 1,500 units

of B737 vertical fins in 1996 and is currently able to produce 21 to 24 units of

vertical fins per month. Boeing manufactures 31 B737 planes per month. Nearly

two-thirds of the B737 worldwide fleet are equipped with vertical fins produced

by XAIC. Boeing and XAIC did not reveal the total value of the contract. "Since

the 1980s, Boeing has purchased parts and components worth more than $1.5

billion from China. That (the purchasing volume) will more than double in the

coming years," said George Maffeo, vice-president for supplier management,

airplane programs, Boeing Commercial Airplanes. Boeing's archrival Airbus is

also expanding industrial cooperation in China. The total annual value of

Airbus' procurement in China reached over $100 million in 2008 and is expected

to touch $200 million this year and $450 million in 2015. XAIC also produces

wings for Airbus A320 airplanes. The A320 wing is the largest and most

complicated aircraft component a Chinese company has ever made. China is Airbus'

only wing manufacturer outside Europe. XAIC is a major supplier to China's

homegrown regional jet ARJ21 and large commercial passenger aircraft C919 by

manufacturing fuselage and wings. AVIC is using XAIC as a platform to

consolidate its commercial aircraft manufacturing businesses by injecting assets

worth 8 billion yuan into the Shenzhen-listed company. XAIC